Capital Gain Tax

If you sell a house in Andalusia, Spain, in many cases you pay within your sales costs Capital Gain Tax (Impuestos de Ganancias Patrimoniales) over your official profit to the Spanish tax office. This profit is counted over the difference between the value of the property in the Purchase Deeds and Selling Deeds of the notary minus certain fiscal deductions. In case you obtained the property through an inheritance, the worth is taken from the Inheritance Deeds.

The lawyers of C&D Solicitors can take care of the total sale of your property in Andalusia and provide you with tax advice about deductions and exemptions based on your personal situation and acquisition/sales date. If you are a non-fiscal resident in Spain -either from European Union or not- we can also take care of the Capital Gain Tax declaration or return itself.

Tax rates for fiscal resident and non-fiscal resident sellers from and outside the EU

There are three kinds of vendors/sellers according to the tax office: those who are fiscal-resident in Spain, non-fiscal residents from the EU and non-fiscal residents from outside of the European Union. In case you are a fiscal resident in Spain, this needs to be proven to the notary through a certificate of the Tax Office and these foreign sellers need to declare their profit through the next IRPF income tax for fiscal residents.

-

Non-fiscal resident sellers

Vendors that are not fiscal residents in Spain pay 19% Capital Gain Tax over their net profit when selling a Spanish property (both for EU- and non-EU-resident sellers).

-

Fiscal resident sellers

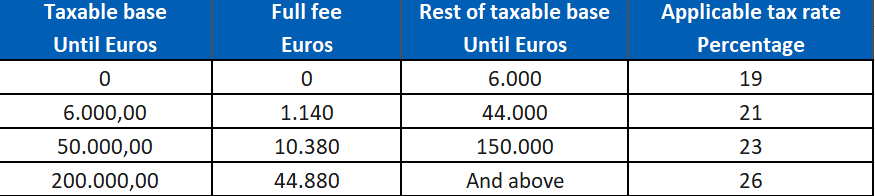

Spanish people and sellers that are official tax-resident in Spain (proven by a certificate from the Tax Office) pay progressively between 19 and 26% of tax over their profit through their following IRPF income tax.

3% CGT down-payment over the sales price for non-fiscal residents

Non-fiscal residents that sell a property in Spain by law need to pay a 3% down payment over the sales price during completion at the notary. So, this is the moment where both parties sign the Deeds and the rest of the house price minus deductions or retentions is paid to the seller. The Spanish law obliges the buyer to deduct/retain this 3% down payment over the purchase price and pay it to the Tax Office on behalf of the seller. This can only be avoided if you are a fiscal resident in Spain and can prove this to the notary by a recent certificate for fiscal residency from the Tax Office.

IMPORTANT: This rule, of course, exists to avoid that the seller leaves Spain without declaring the Capital Gain Tax over his profit. However, even though not all sellers do so, it’s still a legal obligation to do the final declaration if the final amount of tax calculation is higher than the 3% down payment.

Return of the 3% down payment when selling with a loss

You can apply back for the 3% Capital Gain Tax down-payment if you can prove you sold with a loss or just a minor profit. Your lawyer (solicitor) can take care of the paperwork of the tax return and the process takes several months. The money can be transferred directly to your foreign bank account.

The requirement of the IRNR tax declaration over the last 4 years plus the actual one

If you want your lawyer to apply back for the 3%, or part of it, he can make you an exact calculation. However, you need to keep in mind that in this case you need to prove that all owners have paid your last 4 years plus the current one of IRNR income tax for non-fiscal residents in Spain. The IRNR tax is based on the cadastral value of the property and is declare either once a year or, if you rent out, every quarter. If you didn´t pay your IRNR in these last years, ask your lawyer to calculate all costs. Despite the IRNR tax and administration costs, the return might still be in your favour.

Deductions from Capital Gain Tax when selling

To get your tax deductions on the taxable base of the profit approved by the Spanish tax office you need correct and official bills. This means printed bills with a price including VAT (IVA), the fiscal details of the supplier, your own details (including NIE- or DNI-number). In addition, it must contain the details of the property (Land Registry or Cadastre number) so you can´t use the same bill for different properties.

These are examples of the officially allowed deductions:

- ITP Transfer tax (existing properties)

- VAT and AJD tax (new build promotion)

- Legal fees (bill of the lawyer or solicitor)

- Notary costs when buying or inheriting

- Land Registry bill

- Taxes for building licenses

- Local Plusvalue tax (Plusvalia or IIVTNU)

- Real Estate commission over the sale

Deducting reform/renovation costs from the CGT

Also, you can deduct renovation or reform costs that have improved the value of the property, like a new kitchen or bathroom. Read more about this subject in our legal news article:

RENOVATING YOUR HOME? DO IT RIGHT AND PAY LESS TAX WHEN YOU SELL

Official payment justification is required for deduction of Capital Gain Tax

Next to that, you need to have the official payment justification, so either a bank extract from the money transfer or a copy of a bank cheque. Payments done in cash with only a cash receipt proof are not allowed by the Tax Office for deductions of the CGT.

Price over furniture, inventory for seller vs. buyer

It´s important to know that the official value for furniture or inventory in the title deeds doesn´t count as the value of the property. This means that if your purchase deeds show for example € 20.000 for the furniture and you don´t have the same deal with your buyer, you will pay Capital Gain Tax over this amount if you sell with a profit. For this reason, we advise sellers to try to negotiate a (reasonable) price for the furniture. However, if you want to avoid further investigation of the Tax Office, it´s best to never go higher than 10% of the sales price. For the buyer there´s also an advantage at this moment, as he now pays 4% ITP Transfer Tax instead of the normal 7% in Andalusia).

Do you also sell a business activity linked to the property like a B&B (Bed & Breakfast)? Then you could also put a value for for example the goodwill to pay less Capital Gain Tax.

Exemptions/exceptions for CGT payment when fiscal resident

If you sell a property in Andalusia and you are a proven fiscal resident in Spain, there are two scenarios in which you don´t have to pay Capital Gain Tax over your profit. Your lawyer (solicitor) can check if you really fulfil these requirements on paper, as this can be a rather complex matter. In certain circumstances it might even be worth anticipating these tax advantages if you´re flexible at the moment of your future sale.

-

65+ and selling your first residency home

If you are more than 65 years old and you are selling your first residency home with a profit then you don´t have to pay Capital Gain Tax. For this, you need to be inscribed at the Town Hall (empadronamiento) for the last 3 years at this address and be a fiscal resident in Spain. It´s not a requirement to invest your sales money in another first residency house.

-

Selling and buying a first residency home

There is a possibility to have an exemption on the Capital Gain Tax if you sell a first residency home but also buy a new first residency home. (In certain cases it´s even possible to transfer the Capital Gain Tax exemption on to a first-residency home in another country. You can ask your lawyer for the exact conditions.)

You have to declare so in your IRPF tax declaration and you can only do so if you comply with the following requirements.

-

- Both the sold property and bought property need to be proven to be your first residency through the empadronamiento registration of the Town Hall.

- You must be a tax resident in Spain (tax certificate of the Tax Office)

- The new purchase should be done within 2 years after the house is sold. Be aware that the dates of signing the Title Deeds or Purchase / Sales deeds at the notary only count, not of the private purchase contracts. (This of course is extra important when it comes to New Build Properties.) However, it´s theoretically also allowed for this exemption to first buy the new house and then sell the first house within 2 years.

- You can only transfer the proportional part of the Capital Gain Tax according to the worth of the properties. So, if you sell for 500.000 euros and buy for 250.000 euros, you can only transfer half of the Capital Gain Tax onto the next property and the other half you´ll need to pay now.

- If you for whatever reason want to keep a certain amount in cash money for which you decide to have a Spanish mortgage, the Capital Gain tax-exemption also is applicable on this amount.

C&D Solicitors, specialist lawyers for your property sale in Andalusia

Are you thinking about selling your urban or rural home? Then read all about the advantages of hiring a specialized lawyer for your sale in Andalusia through this link.